World First

AI Credit Builder

Monitor your credit report, fix errors, and boost your approval odds in real time.

Powered by TomoCredit AI for a seamless, secure credit-building experience —

with automated insights, instant disputes, and optimized capital accessibility.

Monitor your credit report, fix errors, and boost your approval odds in real time.

Powered by TomoCredit AI for a seamless, secure credit-building experience —

with automated insights, instant disputes, and optimized capital accessibility.

Trusted by 4.5 Million Users

4.2

4.2

+102 pts

+102 pts

1 in 4 users average increase *

1 in 4 users average increase*

1 in 4 users average increase *

4M+

4M+

Total Credit Score Increased

Total Credit Score Increased

Total Credit Score Increased

4.5 M

4.5 M

Users

Users

Users

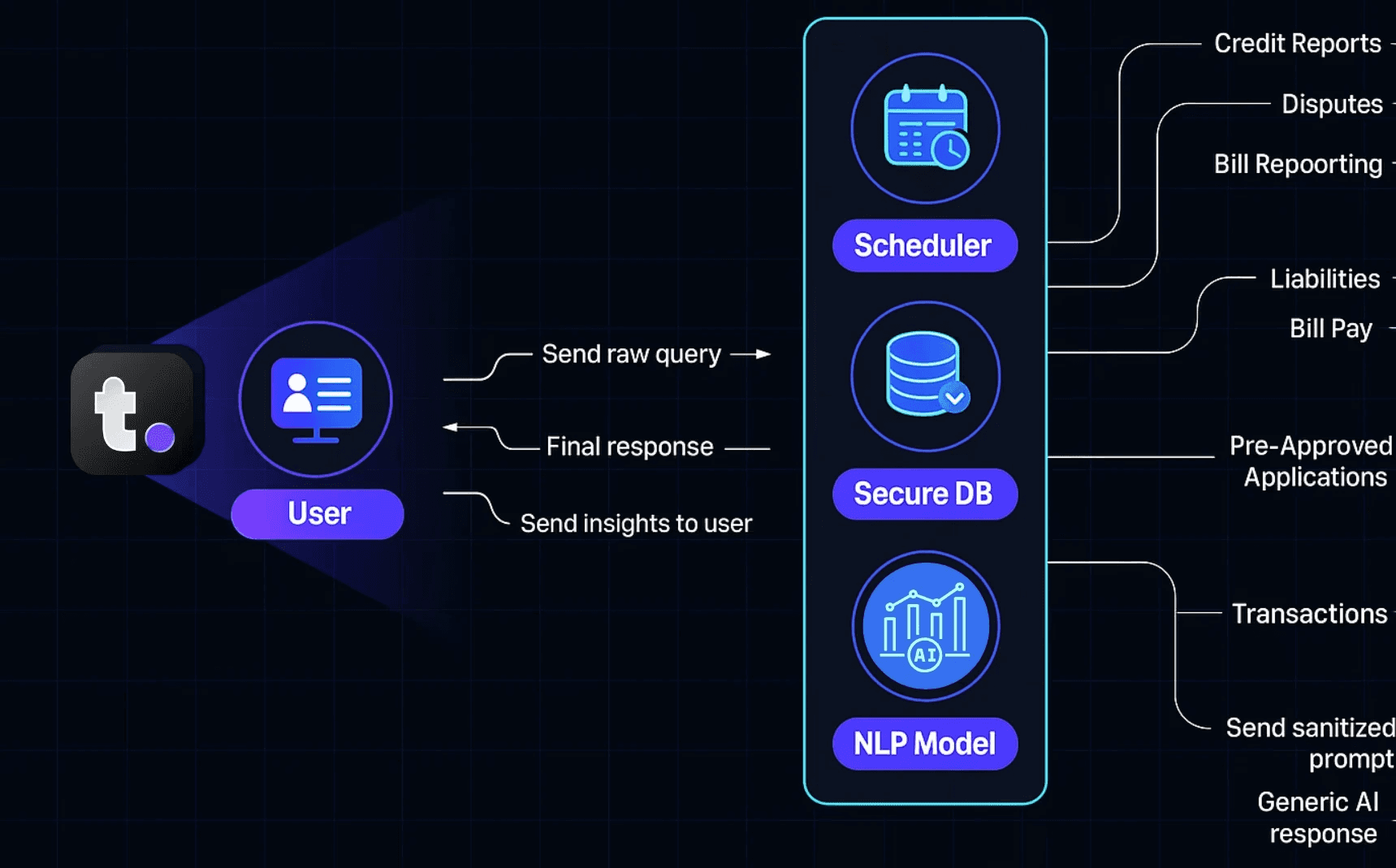

DATA-DRIVEN AUTOMATION

DATA-DRIVEN AUTOMATION

The Tomo Ecosystem

We know what it’s like to have no credit history but big financial goals. — That’s why we built Tomo — a unified system that helps everyone build, boost, and accelerate the path to financial freedom.

We know what it’s like to have no credit history but big financial goals. — That’s why we built Tomo — a unified system that helps everyone build, boost, and accelerate the path to financial freedom.

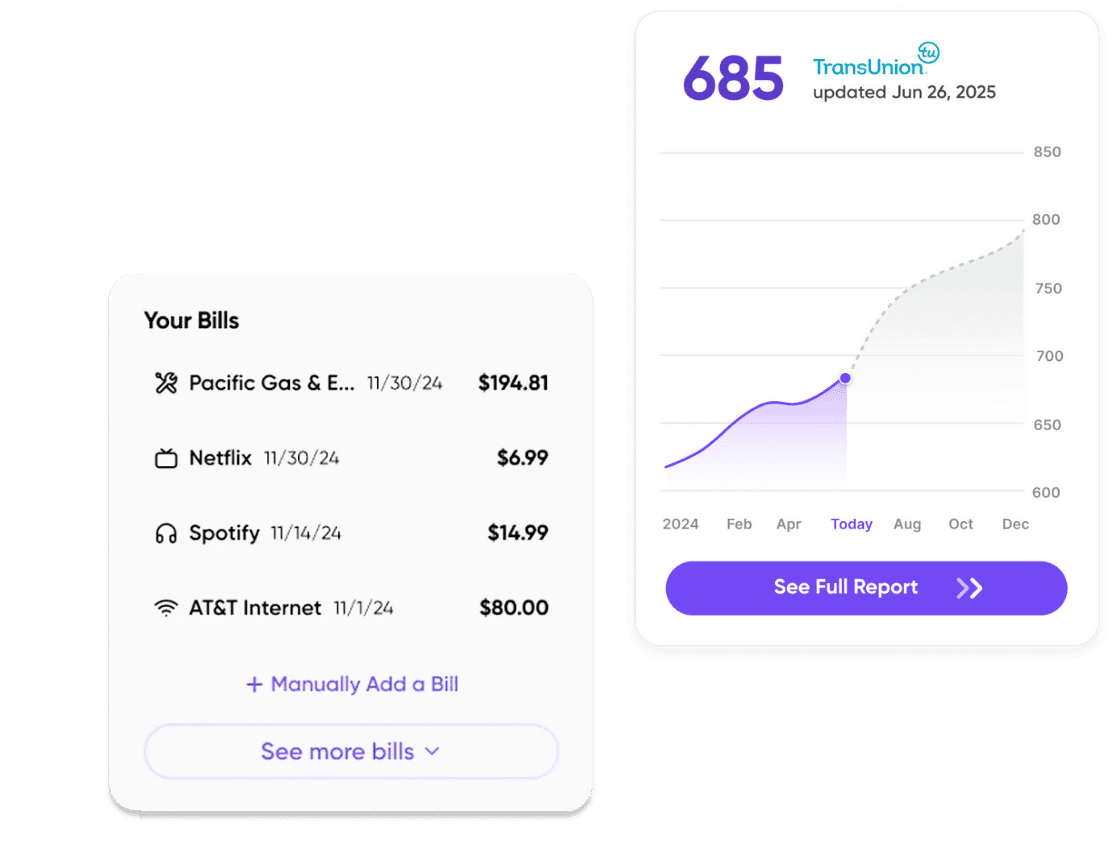

Real-Time Analytics

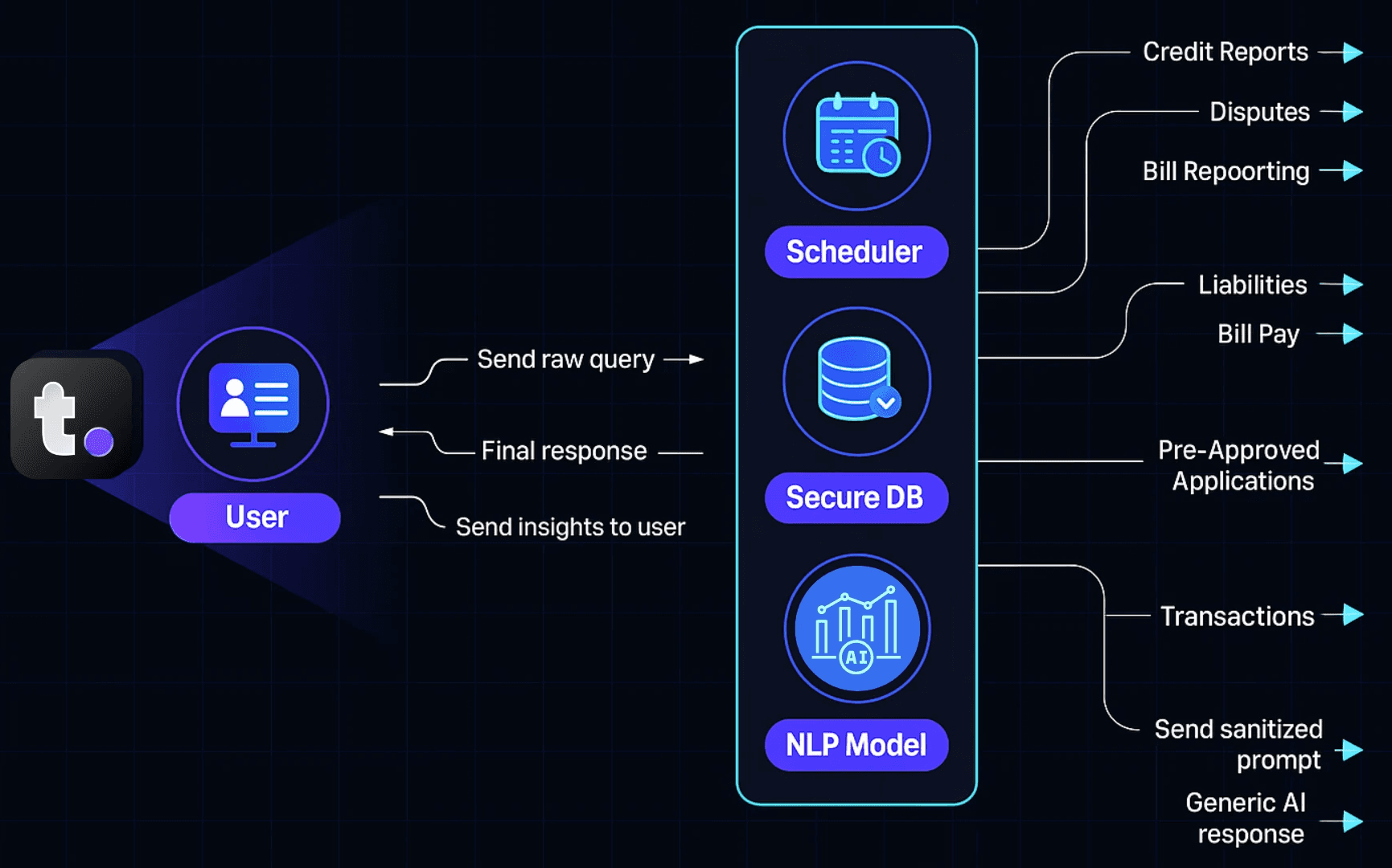

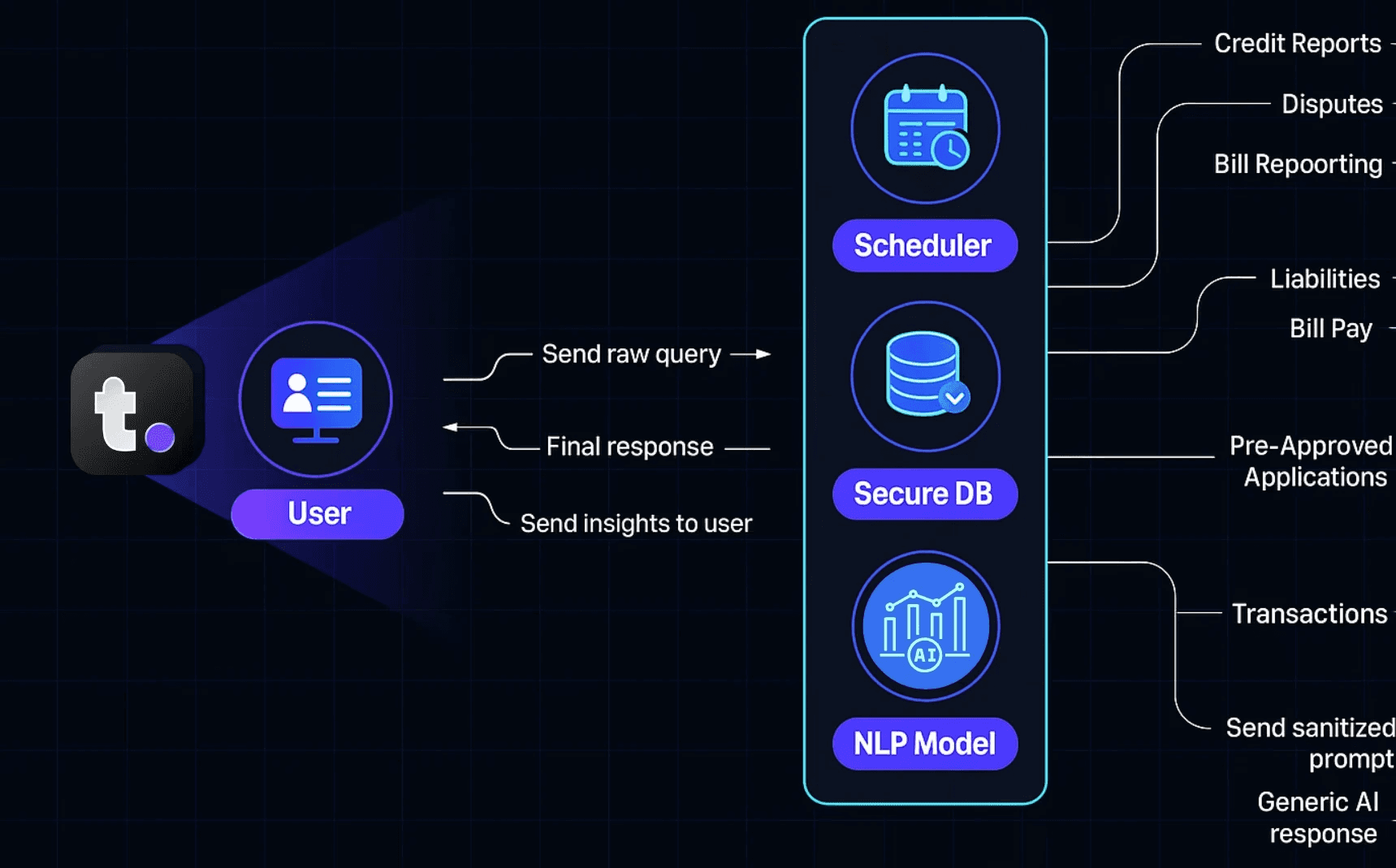

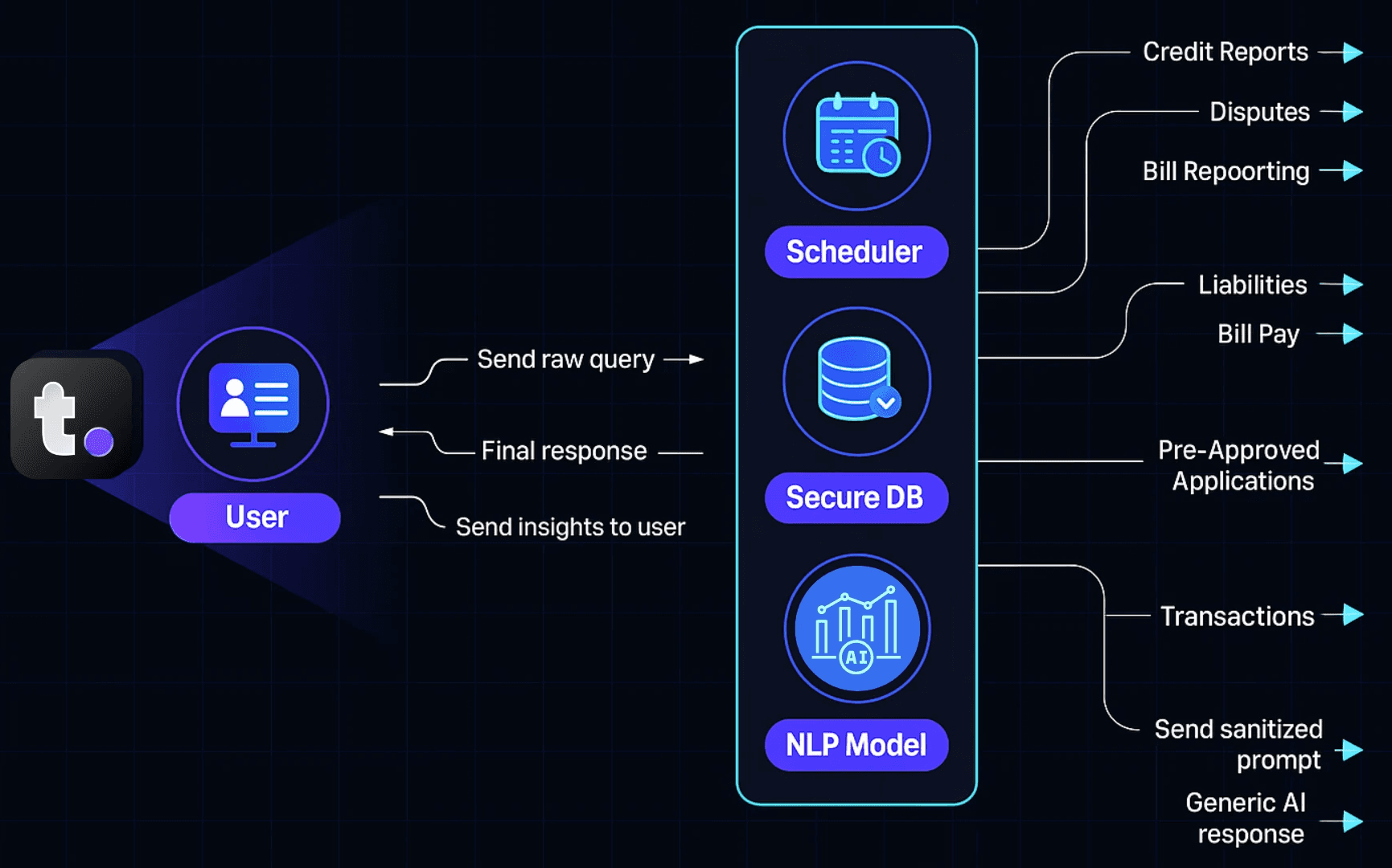

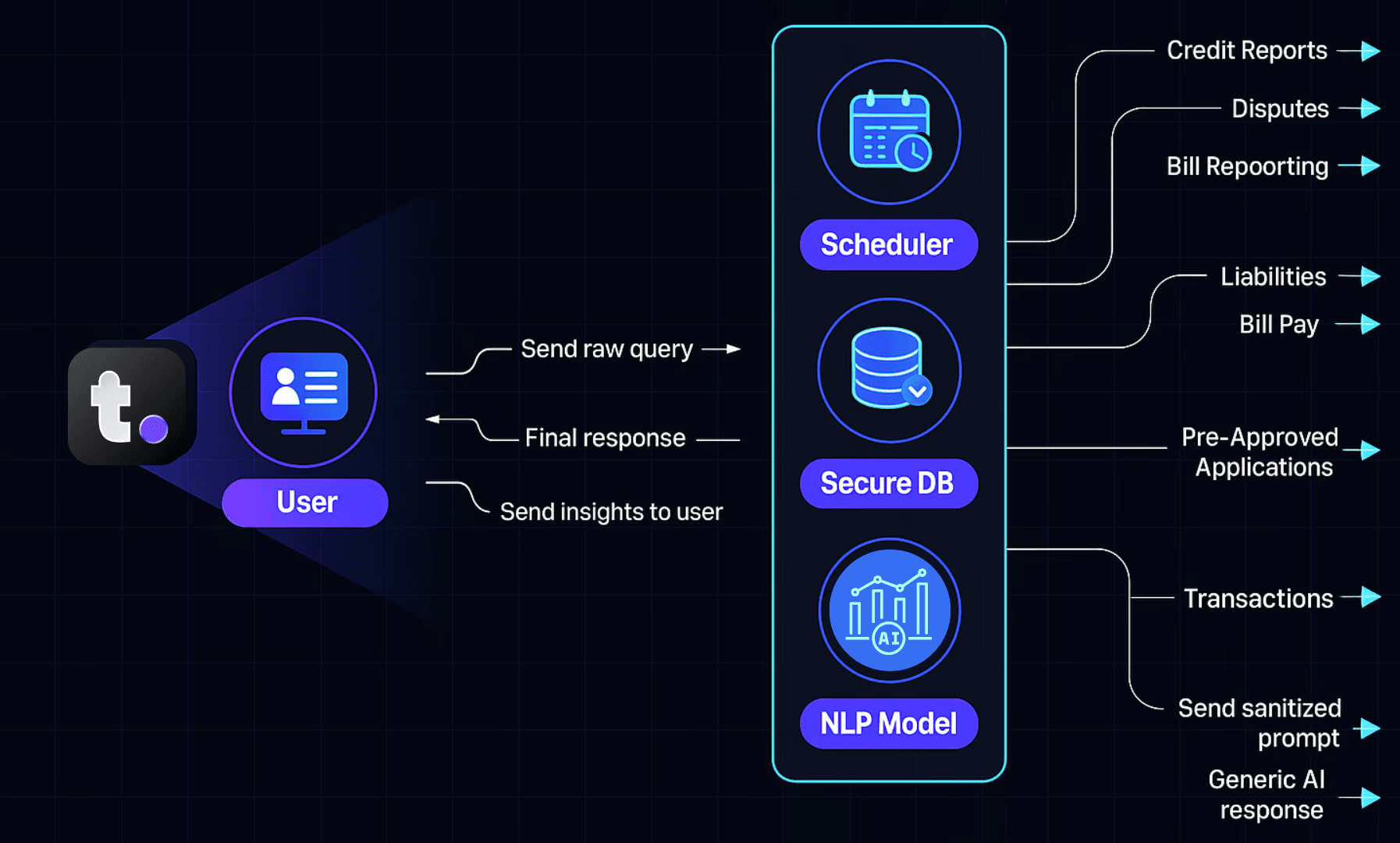

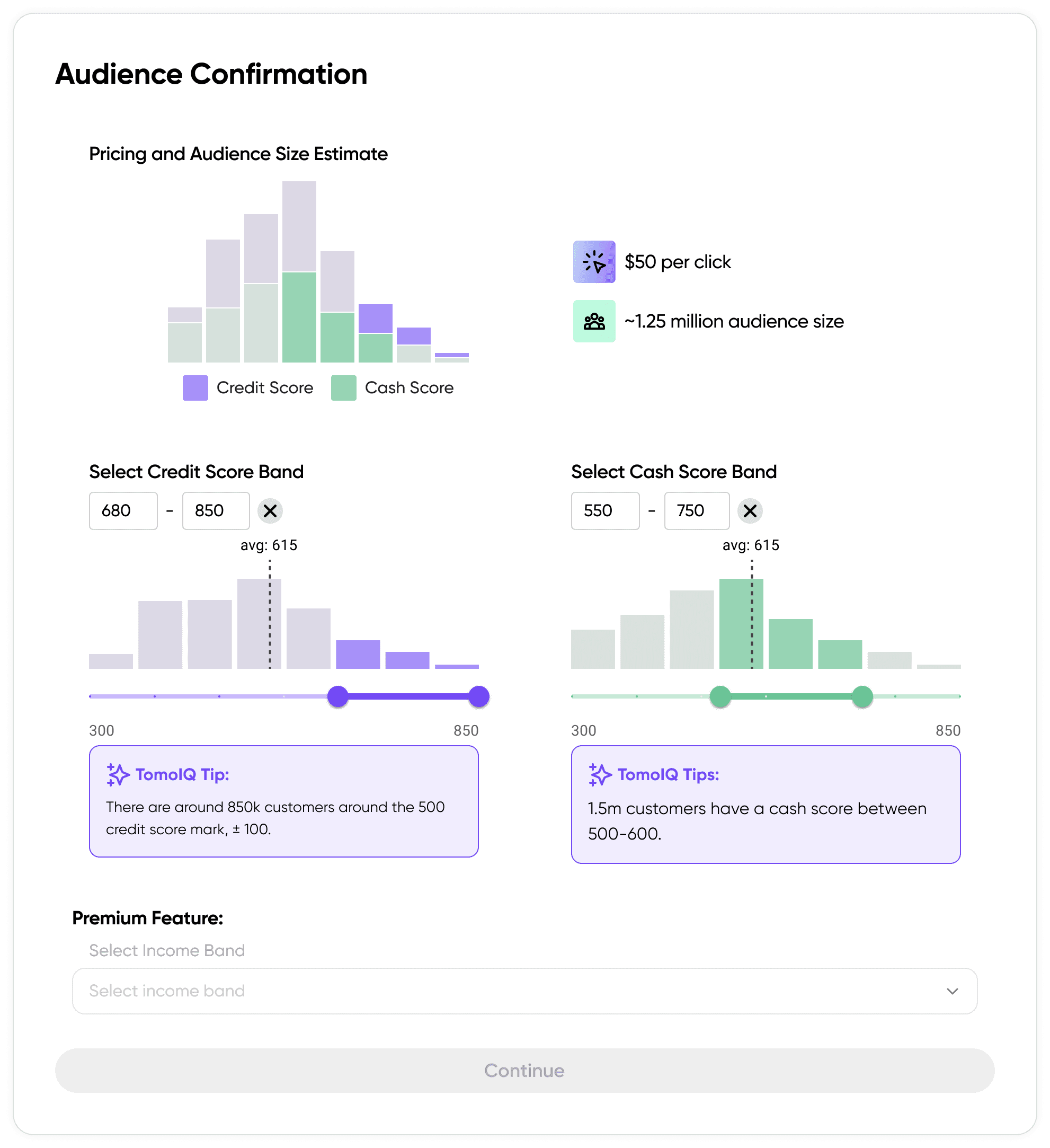

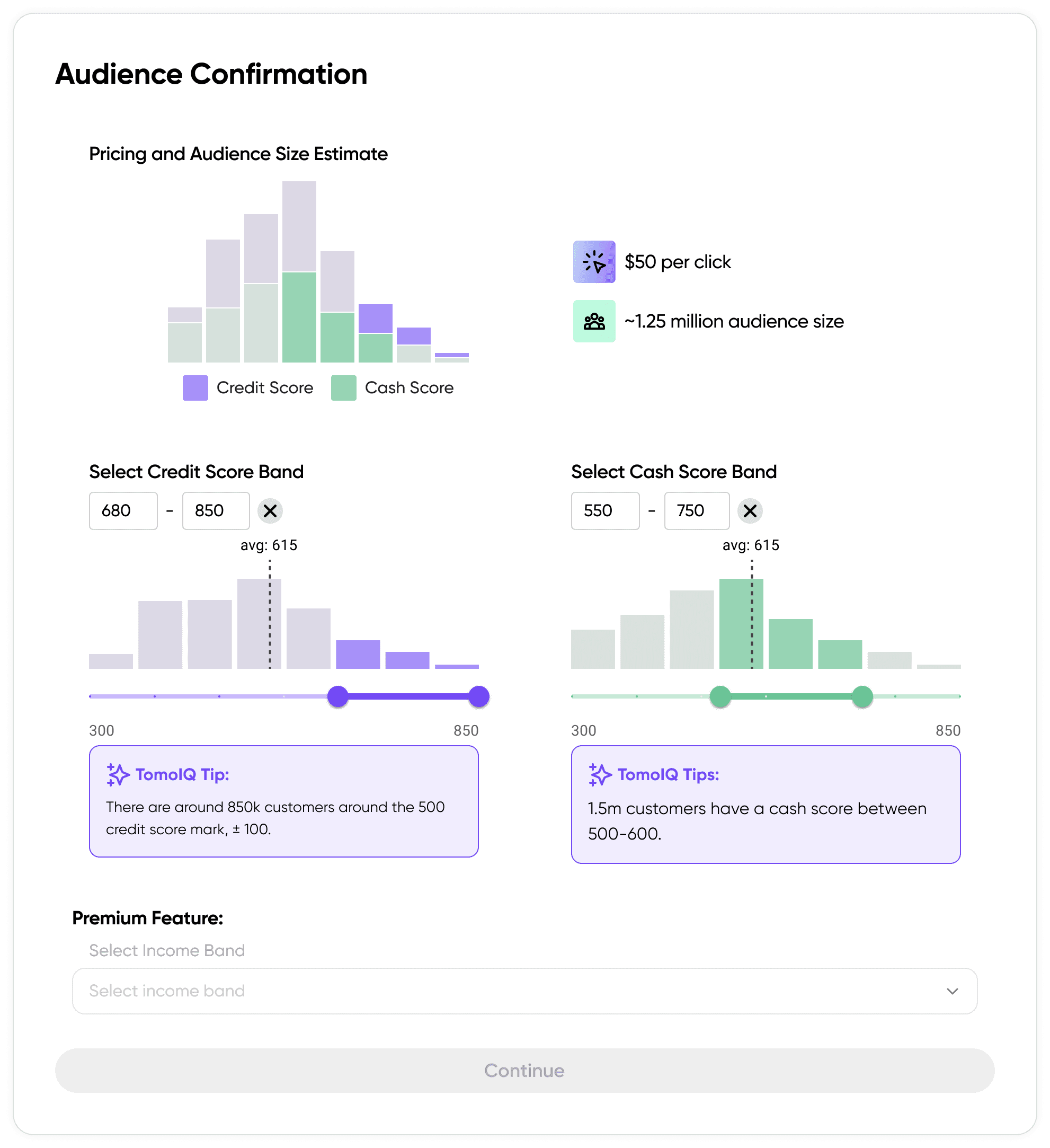

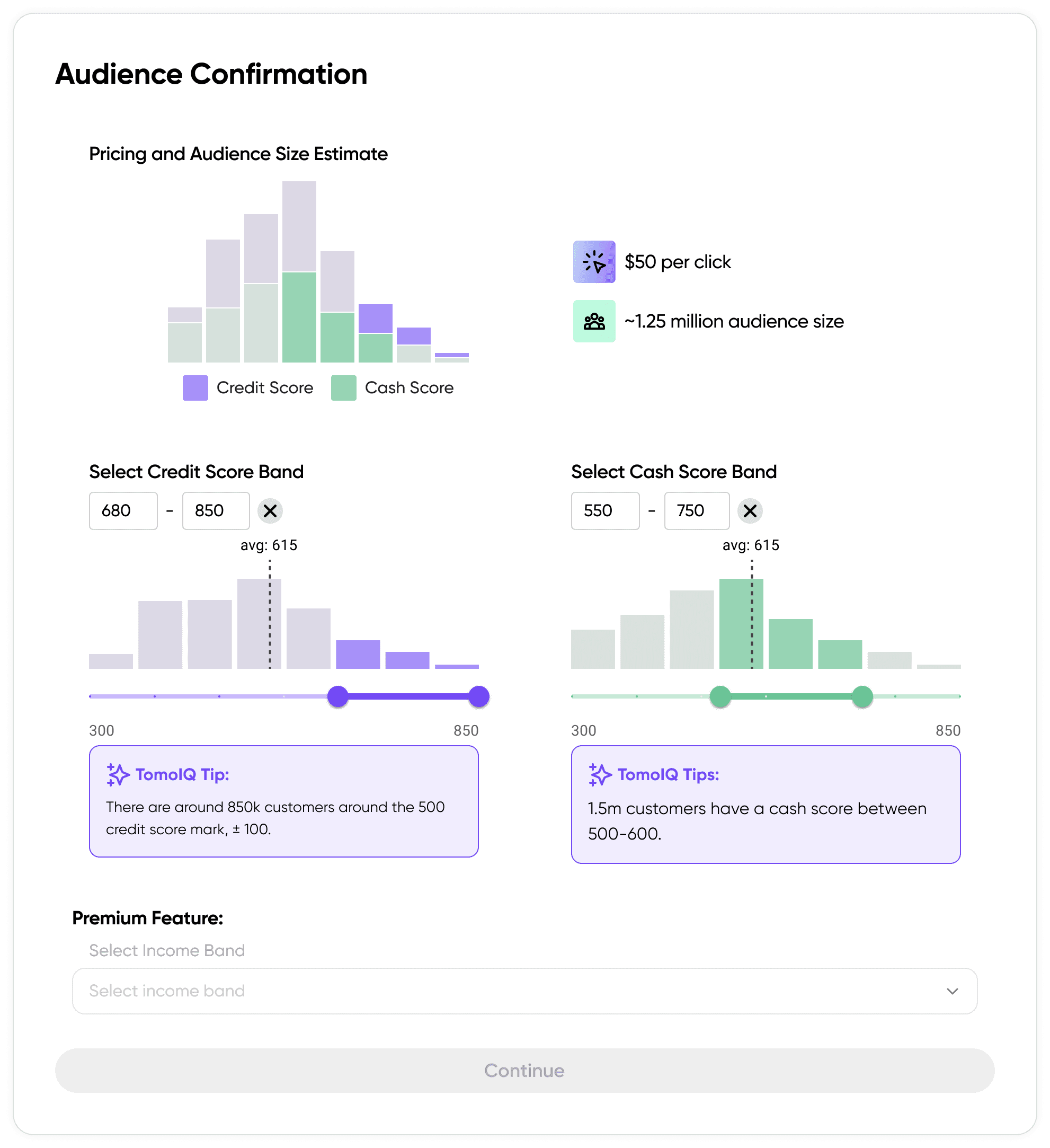

TomoIQ

Powered by our private LLM, the AI financial coach proactively guides you toward smarter capital access decisions. From automating credit error disputes to matching you with the most suitable financial products, Tomo empowers you to optimize capital gains through real-time, intelligent credit insights.

Powered by our private LLM, the AI financial coach proactively guides you toward smarter capital access decisions. From automating credit error disputes to matching you with the most suitable financial products, Tomo empowers you to optimize capital gains through real-time, intelligent credit insights.

Powered by our private LLM, the AI financial coach proactively guides you toward smarter capital access decisions. From automating credit error disputes to matching you with the most suitable financial products, Tomo empowers you to optimize capital gains through real-time, intelligent credit insights.

Seamless Integrations

TomoBoost

Turning credit into new possibilities — the smarter way to build financial confidence.

TomoBoost helps you move from “thin file” to “financially thriving”, increasing both Credit scores (VantageScore 4.0) and our proprietary TomoScore (cashflow score) — combining traditional credit-building with real-time AI cashflow intelligence to deliver a fuller, fairer picture of financial health.

Turning credit into new possibilities — the smarter way to build financial confidence.

TomoBoost helps you move from “thin file” to “financially thriving”, increasing both Credit Score (VantageScore 4.0) and our proprietary TomoScore (cashflow score) — combining traditional credit-building with real-time AI cashflow intelligence to deliver a fuller, fairer picture of financial health.

Turning credit into new possibilities — the smarter way to build financial confidence.

TomoBoost helps you move from “thin file” to “financially thriving”, increasing both FICO scores and our proprietary TomoScore (cashflow score) — combining traditional credit-building with real-time AI cashflow intelligence to deliver a fuller, fairer picture of financial health.

TomoCredit

Intelligent Capital Synergy

TomoCredit is not just as a marketplace, but as a private LLM–powered credit intelligence engine — one that learns from user data securely to optimize both access to capital and financial outcomes.

TomoCredit is not just as a marketplace, but as a private LLM–powered credit intelligence engine — one that learns from user data securely to optimize both access to capital and financial outcomes.

The future of financial intelligence

The future of

financial intelligence

Tomo brings transparency, intelligence, and efficiency to credit and capital systems — connecting people and opportunity through data.

*1 in 4 users achieved an average credit score increase of 100+ points (VantageScore 3.0), based on a sample of 1,960 users who maintained on-time payments and had no new delinquencies or collections added to their credit profile during the period. Individual results may vary. Late payments may negatively impact credit score.

*1 in 4 users achieved an average credit score increase of 100+ points (VantageScore 3.0), based on a sample of 1,960 users who maintained on-time payments and had no new delinquencies or collections added to their credit profile during the period. Individual results may vary. Late payments may negatively impact credit score.